What is money? Money is anything that is generally accepted as a medium of exchange, a measure of value, a store of value, and a standard for deferred payments.

The above-mentioned four things are the functions of money (What is Money).

Though initially money was invented as a medium of exchange, with the advancement of human civilization, money gradually found its other uses as well.

- Money is now used as a MEASURE OF VALUE, i.e., the value of all goods and services is now expressed in terms of money.

- Money is now used as a STORE OF VALUE, i.e., money is used as an instrument of saving.

- Money is now used as a STANDARD OF DEFERRED PAYMENTS, i.e., money is a far better way to make payments in the future.

For example, a rupee in India is an example of money, as it is a common medium of exchange here. Likewise, a dollar in the USA is also money.

Evolution of Money (What is Money)

Initially, when human wants were limited Goods were exchanged for goods (barter exchange system/CC-economy, i.e., an economy in which commodities are exchanged for commodities).

With the multiplicity of wants, the barter system proved to be an inefficient system of exchange because of the following limitations:

- Double coincidence of wants.

- lack of a common unit of value.

- Difficulty of future payments.

- Difficulty of storage of value.

Functions of Money (What is Money)

PRIMARY OR BASIC FUNCTIONS

1. MEDIUM OF EXCHANGE: Money acts as a medium of exchange for all goods and services.

- The use of money has greatly facilitated the process of exchange by dividing it into two parts, i.e., sale and purchase. It has removed the difficulty of the double coincidence of wants found under the barter system.

- Therefore, in the modern world we hardly find any evidence of exchange of goods and services without the use of money.

EXAMPLE: You pay 10 RS to buy a pen. The seller receives 10 rupees from you by selling the pen. So, a pen is exchanged for 10 RS.

2. MEASURE OF VALUE: Money helps to measure the value of goods and services in terms of price.

- The use of money has completely removed the confusion regarding the value of one good/service. This function has greatly facilitated the process of exchange of different goods and services.

- The value of a good is determined by multiplying its price with the quantity purchased. Since the price is expressed in monetary units, the value of a good is also expressed in monetary terms.

EXAMPLE: Let the price of rice be Rs20 per kilogram. One bag full of rice weighs 25 kilograms. Then the value of the bag of rice is Rs20 multiplied by 25 = Rs500.

SECONDARY FUNCTIONS

1. STORE OF VALUE OR WEALTH: Money is the most convenient and economical means to store wealth, which does not lose its value so quickly over time.

- As a medium of exchange, you can pay off money to buy goods. This means if you have money, you have the power to purchase a good or a service. So, money has purchasing power. The value of the good is contained in that purchasing power.

- Hence, the value of a good is indirectly stored in money. you hold. Similarly, as a seller of goods, you receive the money, which means the value of the goods you sold comes back to you through money.

2. STANDARD OF DEFERRED PAYMENTS: Deferred payments are those payments that are promised to be made in the future.

- Money acts as a means of deferred payments mainly because it has general acceptability.

- Its value remains relatively constant over time, and it is more durable as compared to other goods.

- In the case of borrowing and lending activities, only money is normally acceptable to be paid at a future date.

- Goods lose their value over time, and due to the possibility of a lack of double coincidence of wants, they are not acceptable to settle debts in the future.

What is money supply?

Money supply refers to the total amount of money held by the public of an economy at a particular point in time. (it is a stock concept.)

Important points about money supply

Money supply only includes the money held by the money-using sector, i.e., the public (individuals & business firms).

It does not include the money-creating sector, i.e., the government and banking system, as cash balances held by them do not come into actual circulation.

The government and the banking systems are the producers of the money, and hence they are the suppliers of money, whereas the public is the demand side of the money supply.

Measure of Money Supply

In India, there are four alternative ways to measure the MONEY SUPPLY in the economy, i.e., M1, M2, M3 & M4.

These measures have been issued by the CENTRAL BANK with the evolution of time since 1977. In our syllabus, the discussion is just limited to M1. (What is Money)

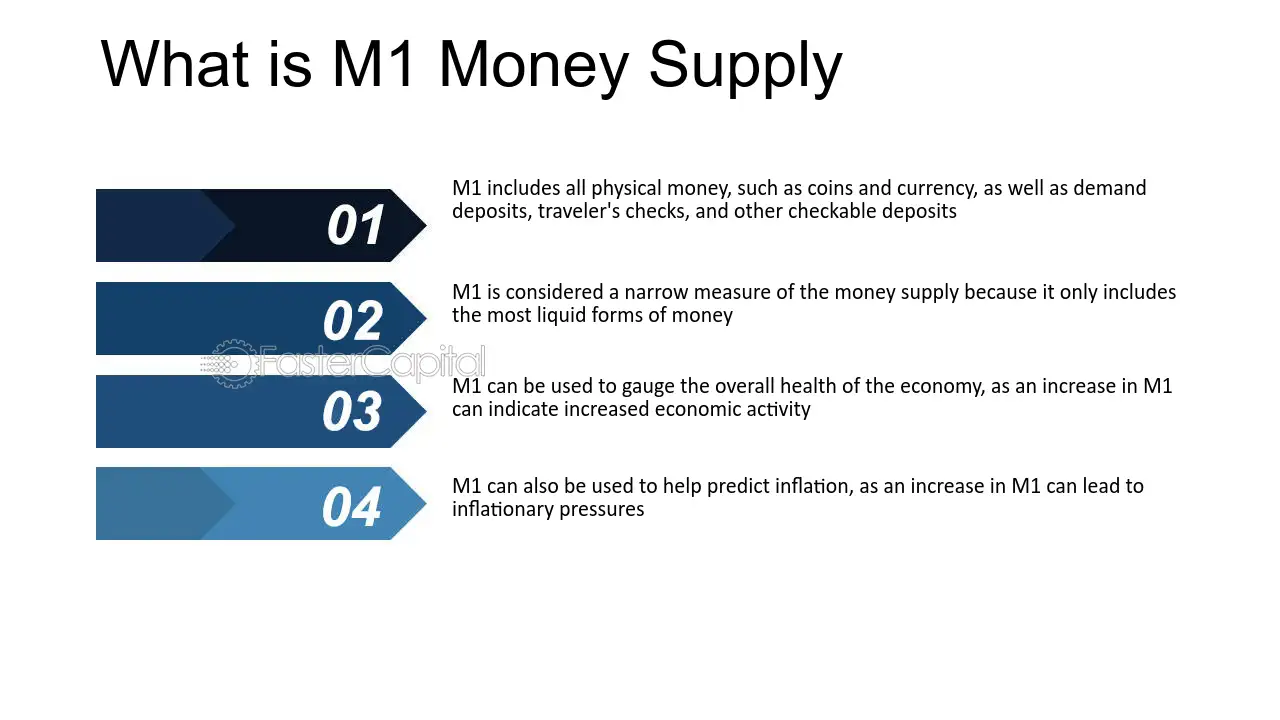

What is M1?

This is the most common and basic measure of money supply. It is also known as “transaction money,” as it can be directly used for making transactions. It is calculated as

M1 = Currency & coins held by the public + Net demand deposits of people with the commercial banks.

+ Other deposits with the Reserve Bank of India.

1. CURRENCY & COINS WITH PUBLIC: It consists of paper notes and coins held by the public. Whereas, any currency held by the banks and government should not be included, as they are the suppliers of the money.

2. NET DEMAND DEPOSITS OF PEOPLE WITH THE COMMERCIAL BANKS: It refers to demand deposits of the public with the commercial banks.

Demand deposits are those deposits that can be encashed by issuing checks at any time by the account holders. A demand deposit is treated as equal to currency held, as it is readily accepted as a means of payment.

3. OTHER DEPOSITS WITH THE RBI: It includes deposits held by the RBI on behalf of foreign banks and governments, public financial institutions (NABARD), and international financial institutions (IMF and World Bank).